Technological improvements and shifting consumer expectations are driving a rapid evolution of the retail banking industry. Banks and credit unions alike, are considering a shift toward smaller, more effective placements. Retail and in-line placements successfully answer the challenges of the retail banking evolution.

Financial institutions can now build extremely profitable and operationally effective branches without sacrificing the caliber of the member and customer experience. This is due, in part, to available technology and innovation ingenuity.

Considerations for the Retail Banking Evolution

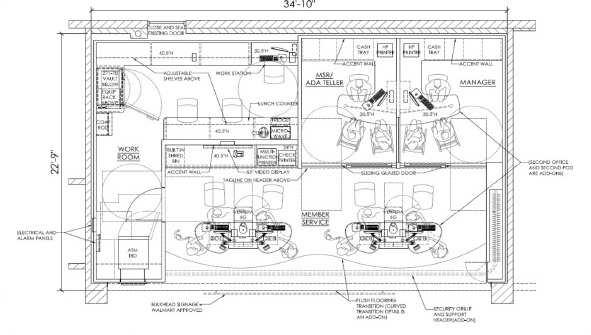

- Adaptable Branch Formats – Smaller branch formats, such as in-line or micro-retail branches, offer affordability and adaptability. By placing branches in busy regions, banks and credit unions minimize their real estate costs while improving consumer and member accessibility. Prioritizing high traffic areas (i.e., retail locations, military bases, university campuses, shopping and residential developments) over densly populated locations opens the door for greater accessiblity and success.

- Enhanced Digital Solutions – Seamless integration of digital solutions within physical branches is made possible with modern banking technology. Customers complete regular transactions swiftly and independently through self-service kiosks or ITMs. These solutions cut down on wait times and operating expenses. They also allow branches to be staffed with a small crew.

- Personalized Services – Thanks to sophisticated data analytics and CRM systems, individualized services are catered to each customer or member’s demands. In other words, increasing client happiness and loyalty promotes long-term profitability. The new experience also equips customers and members to serve as branch ambassadors who refer their family and colleagues.

- Efficient Operations – In addition, staff members may concentrate on high-value interactions thanks to automated procedures and cutting-edge security solutions that streamline branch operations. This lowers operating hazards while increasing efficiency. Your team takes on the role of a financial literacy coach or banking concierge which is a leap above the universal teller model of the early 2000’s.

- Remote Assistance – Members and clients communicate with banking professionals either in person or from the comfort of their own homes. With the use of video conferencing and remote advising services, experience becomes seamless. This same experience can be immulated within the branch (i.e., video conferencing rooms or ITMs) should your customer or member still like the in-person experience. Above all, it guarantees that individuals get the help they require, whenever and wherever they require it.

How Does One Successfully Navigate the Process?

Working with a strategic partner is key to making the transition a success. As a provider with 40-plus years of vertical knowledge, FSI understands your goals. Our experienced team is ready to offer advice and a proven strategy to implement cutting-edge branch solutions. FSI’s proficiency in branch optimization, placement, and design supports a smooth shift to a smaller, more productive branch format.

FSI also has a large portfolio of branch transformation projects. Our speed-to-market approach cannot be matched. Many of our remodel projects are completed in 7 days or less. The use of custom, pre-fabricated wall panels allows us to move fast and efficient. Our design team has over 20 years experience and a keen understanding of how your employees and customers/members experience the branch space. Enjoy our gallery of inspiration.

In conclusion, adopting technology and immersive branch environments help financial institutions attain optimal efficiency, profitability, and outstanding customer and member experiences. No one in the design-build or construction arena has worked more extensively with the financial industry which translates into a partnership that understands that the quality of the branch, not its size, will determine the retail banking evolution.

Interested in learning more, contact us today.

Leave a Reply